Where Your Income Tax Money Really Goes FY 2026

$0.18

You can also download FY 2026 the flyers and print locally:

in English, in color (pdf)

in English, black & white (pdf)

We offer these downloads free of charge, but we really appreciate your donation to support the work of producing this important resource each year. If you can, donate today!

For Pie Charts from previous years, check out the Pie Chart Archives

***NOTE ABOUT SHIPPING*** Once we receive them from the printers, pie chart orders are being mailed no later than 48 hours after receiving the order. Orders of 50 and more are sent priority mail, which arrives in 2-3 days. Postage costs more than 20%, an additional donation is appreciated.

Minimum Order: 20 Pie Charts (for smaller orders we encourage you to download and print your own!)

13170 in stock (can be backordered)

| Quantity | Discount | Discounted price |

| 200 – 499 | $0.03 | $0.15 |

| 500 + | $0.05 | $0.13 |

- Pie Chart Flyers

- War Taxes

Related Resource:

Pie Chart Flyers – Where Your Income Tax Money Really Goes

HOW YOUR TAX DOLLARS ARE USED

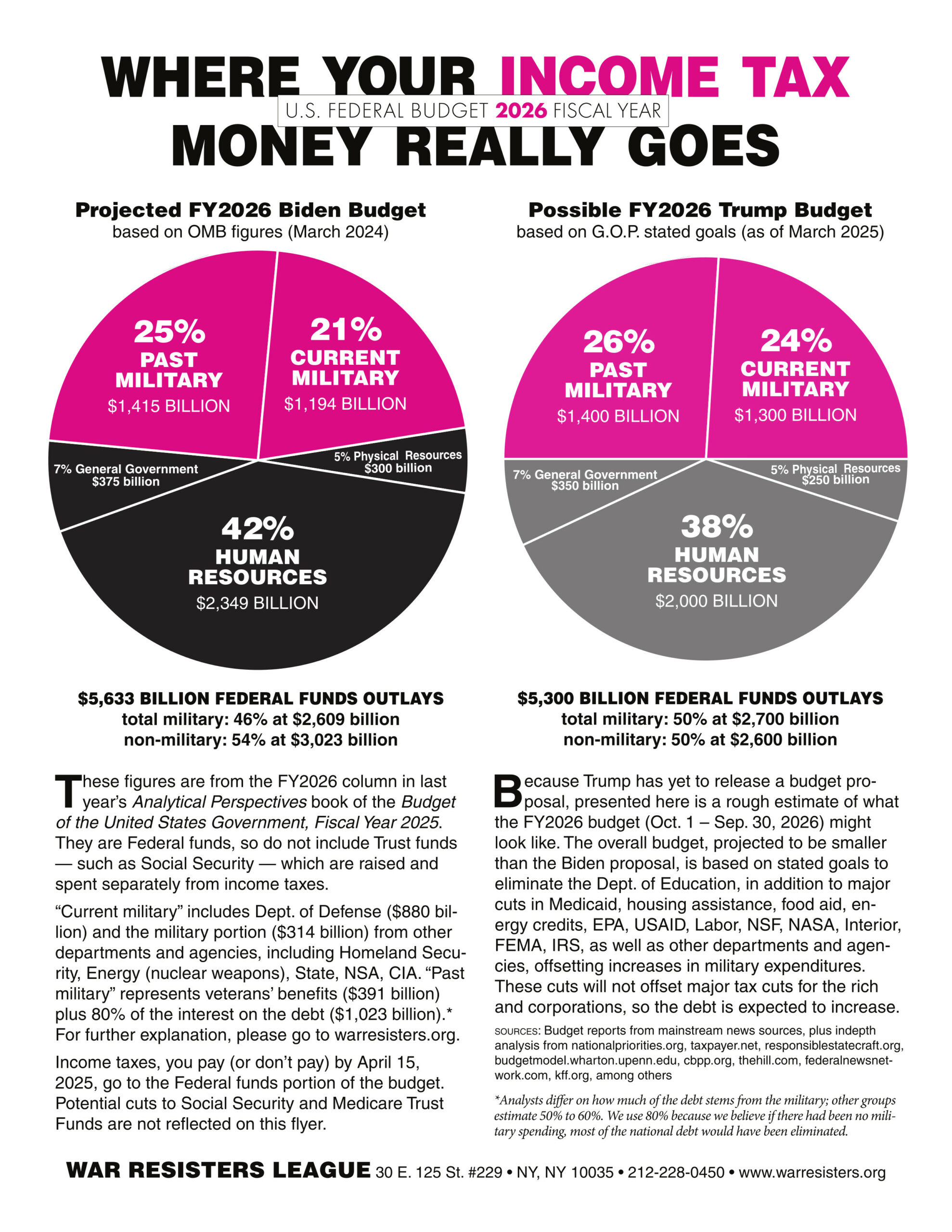

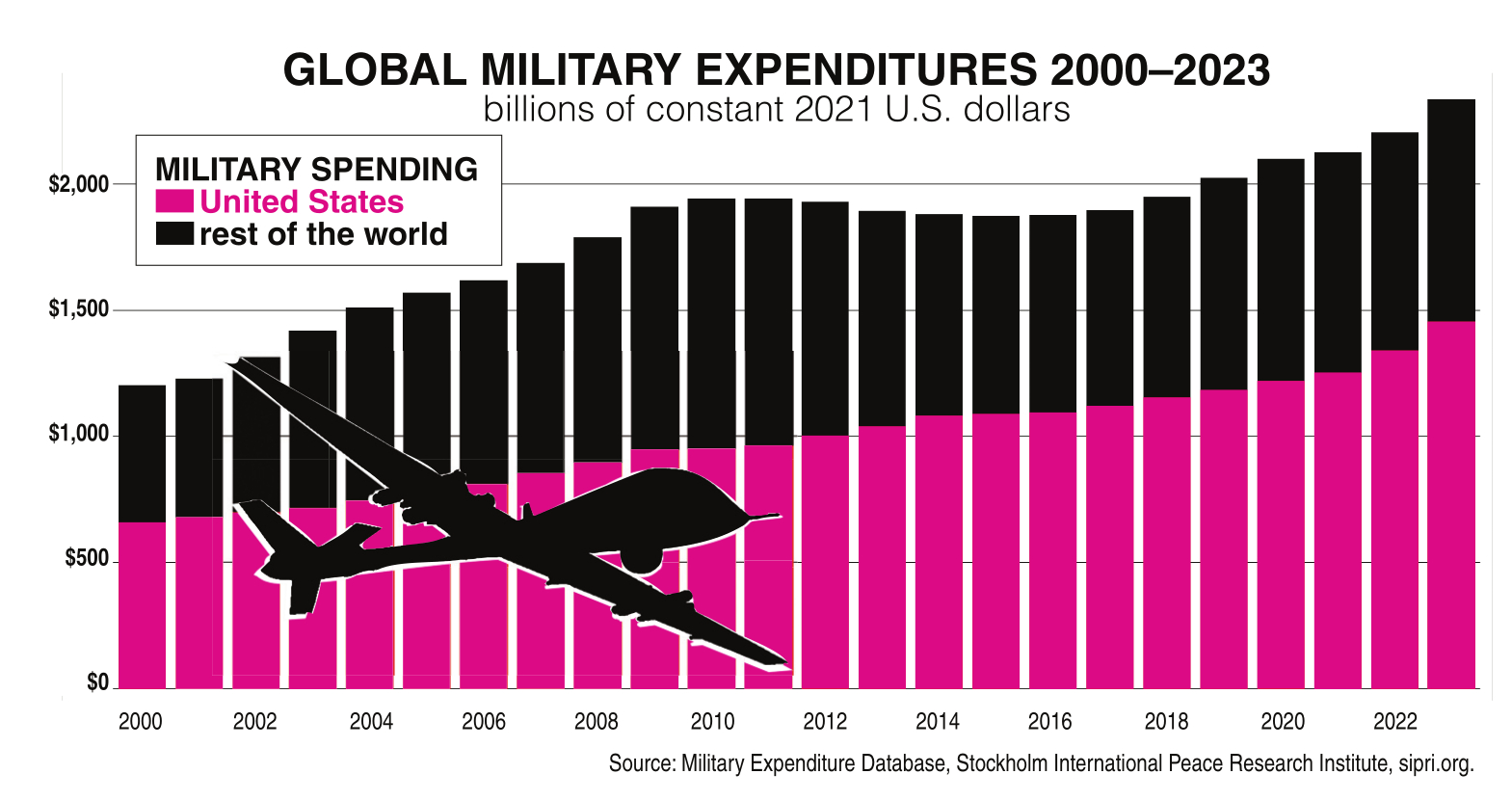

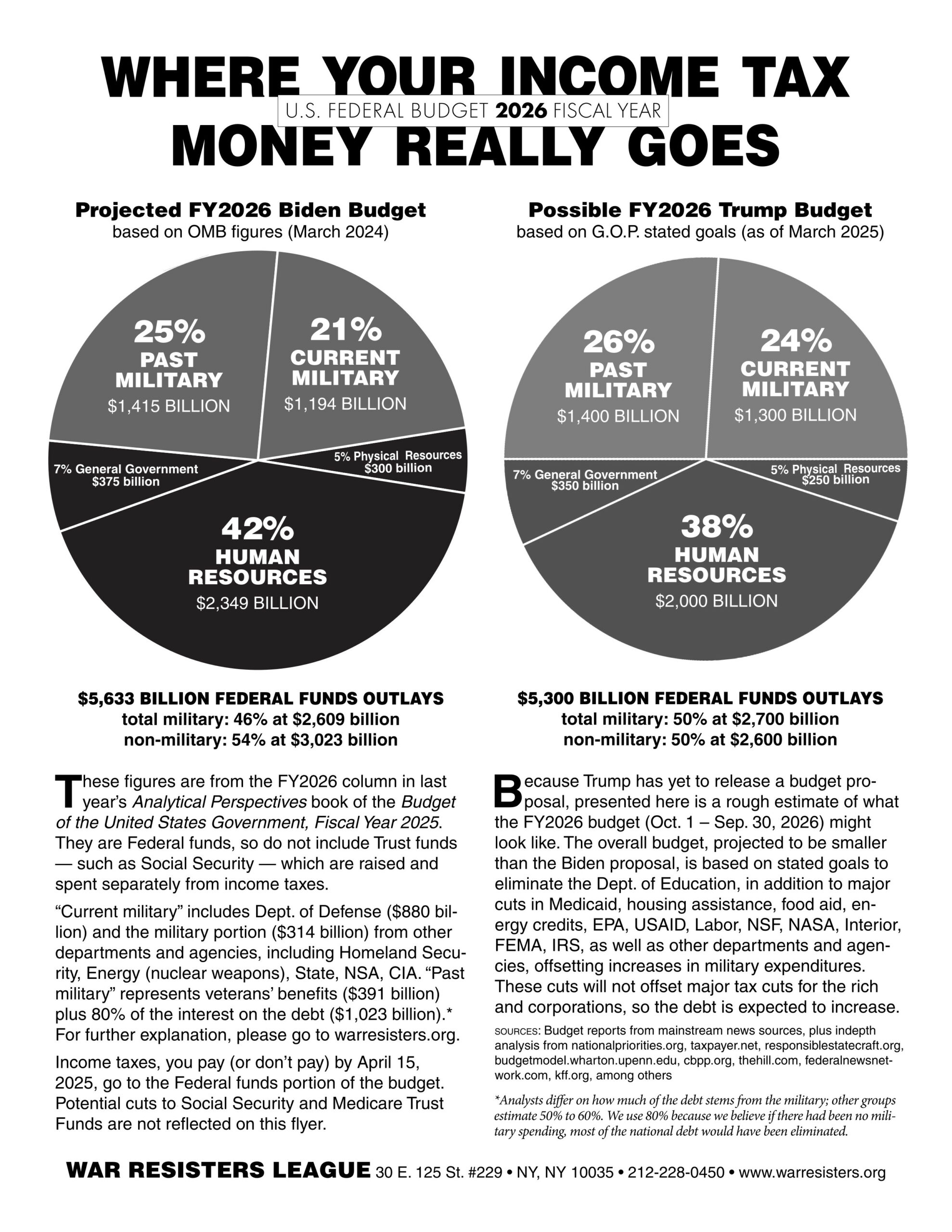

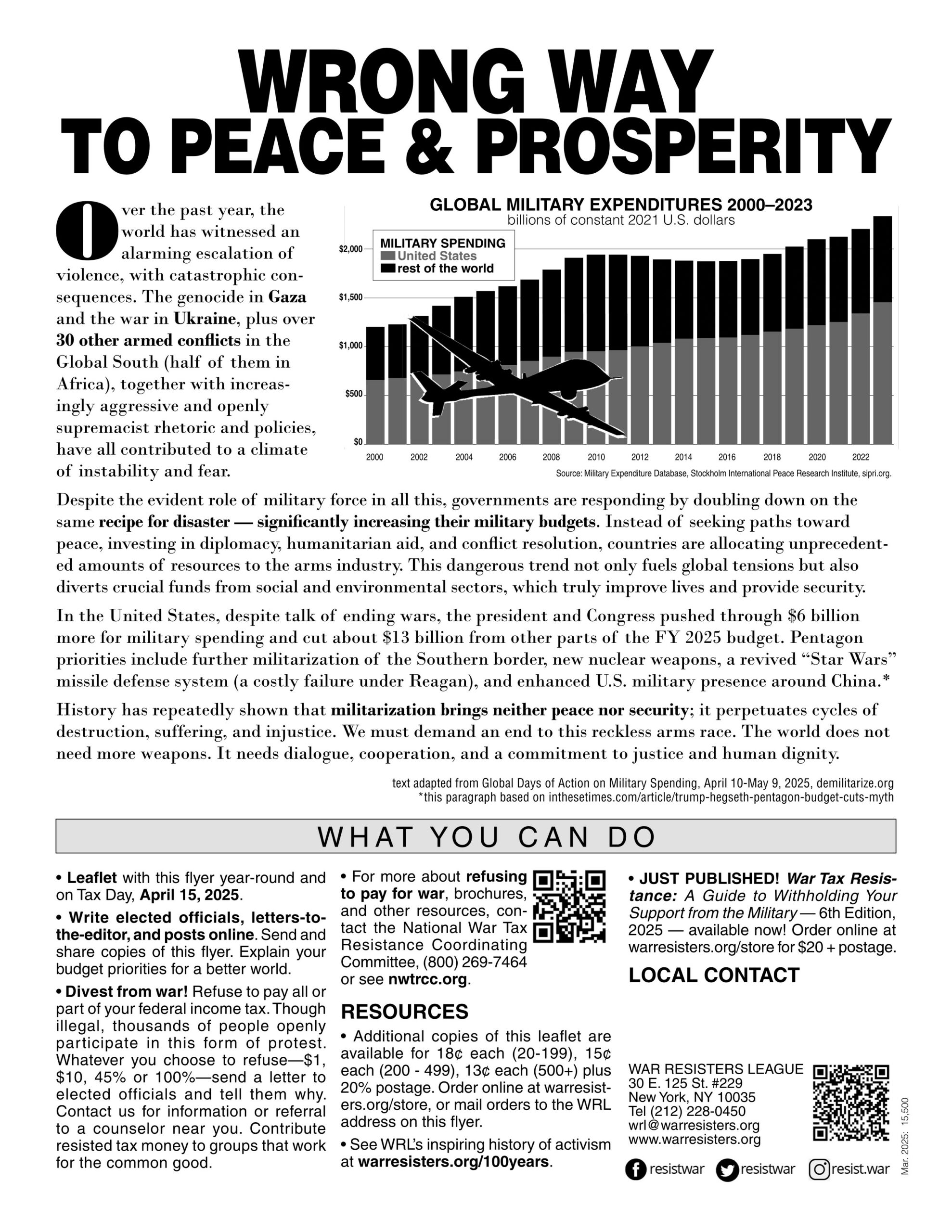

The new War Resisters League’s annual “pie chart” flyer, Where Your Income Tax Money Really Goes, analyzes the Federal Fiscal Year 2026 Budget (FY 2026 is 1 October 2025 – 30 September 2026). This FY2026 issue is being published in March 2025.

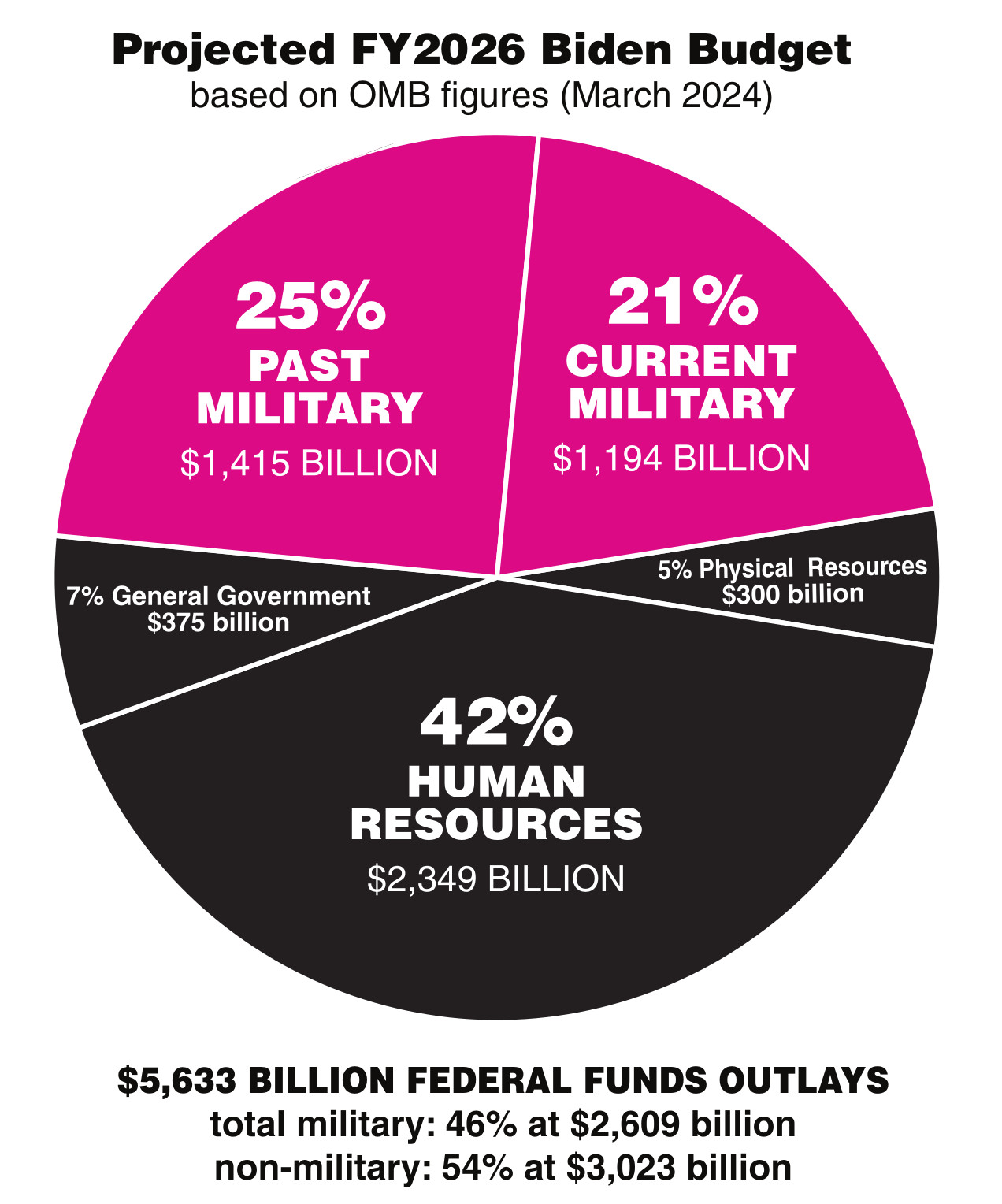

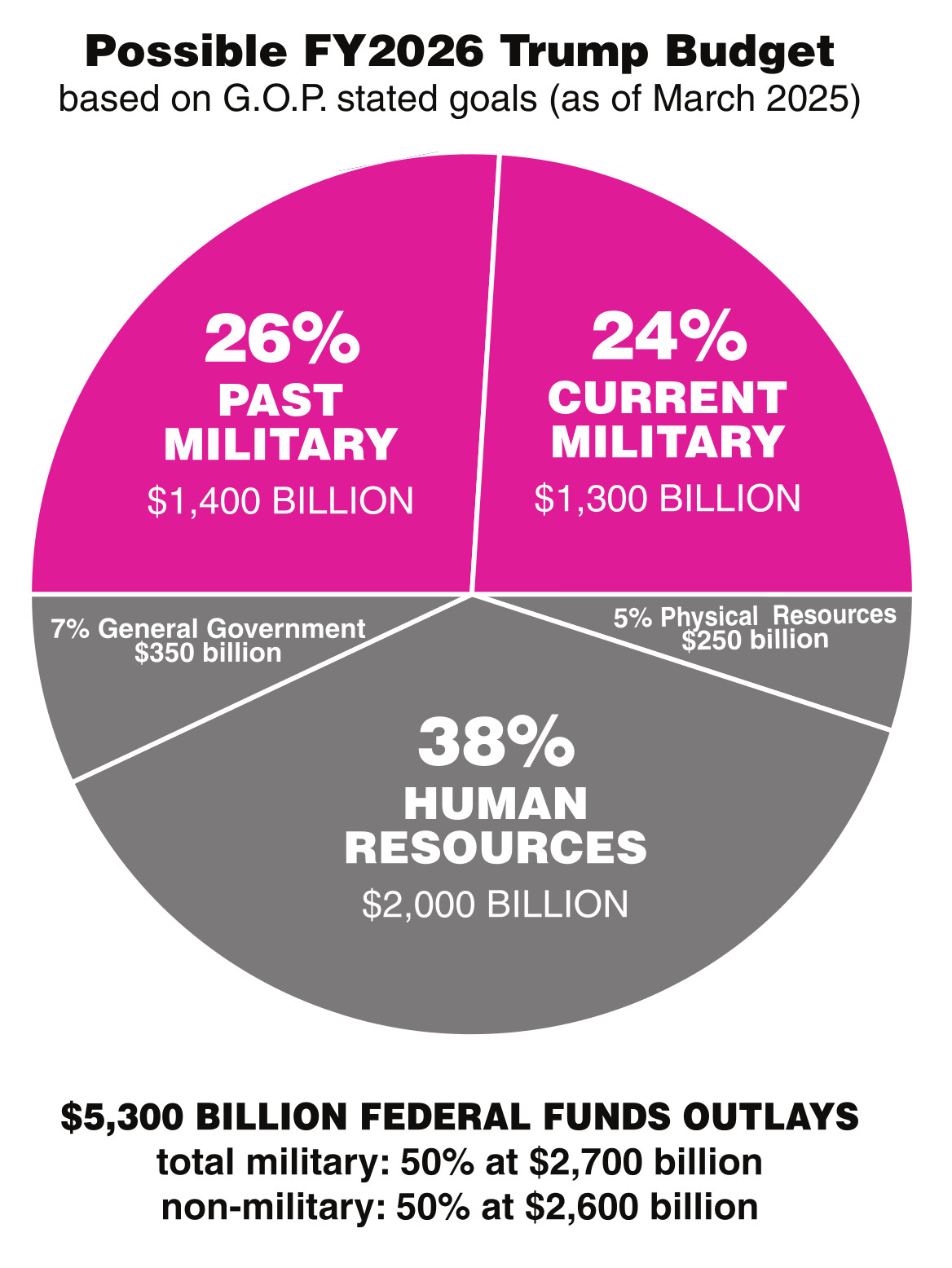

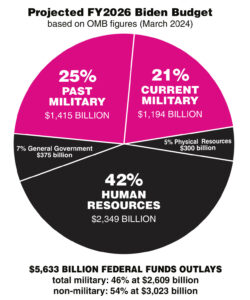

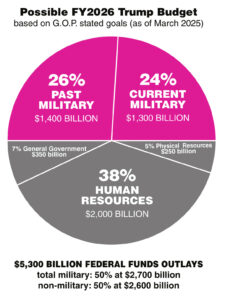

This year’s chart compares the Projected FY2026 Biden Budget based on OMB figures (March 2024) and Possible FY2026 Trump Budget based on G.O.P. stated goals (as of March 2025)

These figures are from the FY2026 column in last year’s Analytical Perspectives book of the Budget

of the United States Government, Fiscal Year 2025. They are Federal funds, so do not include Trust funds

— such as Social Security — which are raised and spent separately from income taxes.

“Current military” includes Dept. of Defense ($880 billion) and the military portion ($314 billion) from other departments and agencies, including Homeland Security, Energy (nuclear weapons), State, NSA, CIA. “Past military” represents veterans’ benefits ($391 billion) plus 80% of the interest on the debt ($1,023 billion).*

Income taxes, you pay (or don’t pay) by April 15, 2025, go to the Federal funds portion of the budget. Potential cuts to Social Security and Medicare Trust Funds are not reflected on this flyer

Because Trump has yet to release a budget proposal, presented here is a rough estimate of what the FY2026 budget (Oct. 1 – Sep. 30, 2026) might look like. The overall budget, projected to be smaller than the Biden proposal, is based on stated goals to eliminate the Dept. of Education, in addition to major cuts in Medicaid, housing assistance, food aid, energy credits, EPA, USAID, Labor, NSF, NASA, Interior, FEMA, IRS, as well as other departments and agencies, offsetting increases in military expenditures.

These cuts will not offset major tax cuts for the rich and corporations, so the debt is expected to increase.

SOURCES: Budget reports from mainstream news sources, plus indepth analysis from nationalpriorities.org, taxpayer.net, responsiblestatecraft.org, budgetmodel.wharton.upenn.edu, cbpp.org, thehill.com, federalnewsnetwork.com, kff.org, among others

*Analysts differ on how much of the debt stems from the military; other groups estimate 50% to 60%. We use 80% because we believe if there had been no military spending, most of the national debt would have been eliminated.

WHAT YOU CAN DO

Get involved in WRL’s organizing and education work: nonviolent direct action training, counter-military recruitment, internationalist work, and more. Visit WRL’s membership handbook at warresisters.org/joinwrl. Find resources to challenge militarism, curb police and border patrol power, strengthen nonviolent action and lift up community resilience!

Write elected officials, letters-to-the-editor, and posts online. Send and share copies of this flyer. Explain your budget priorities for a better world.

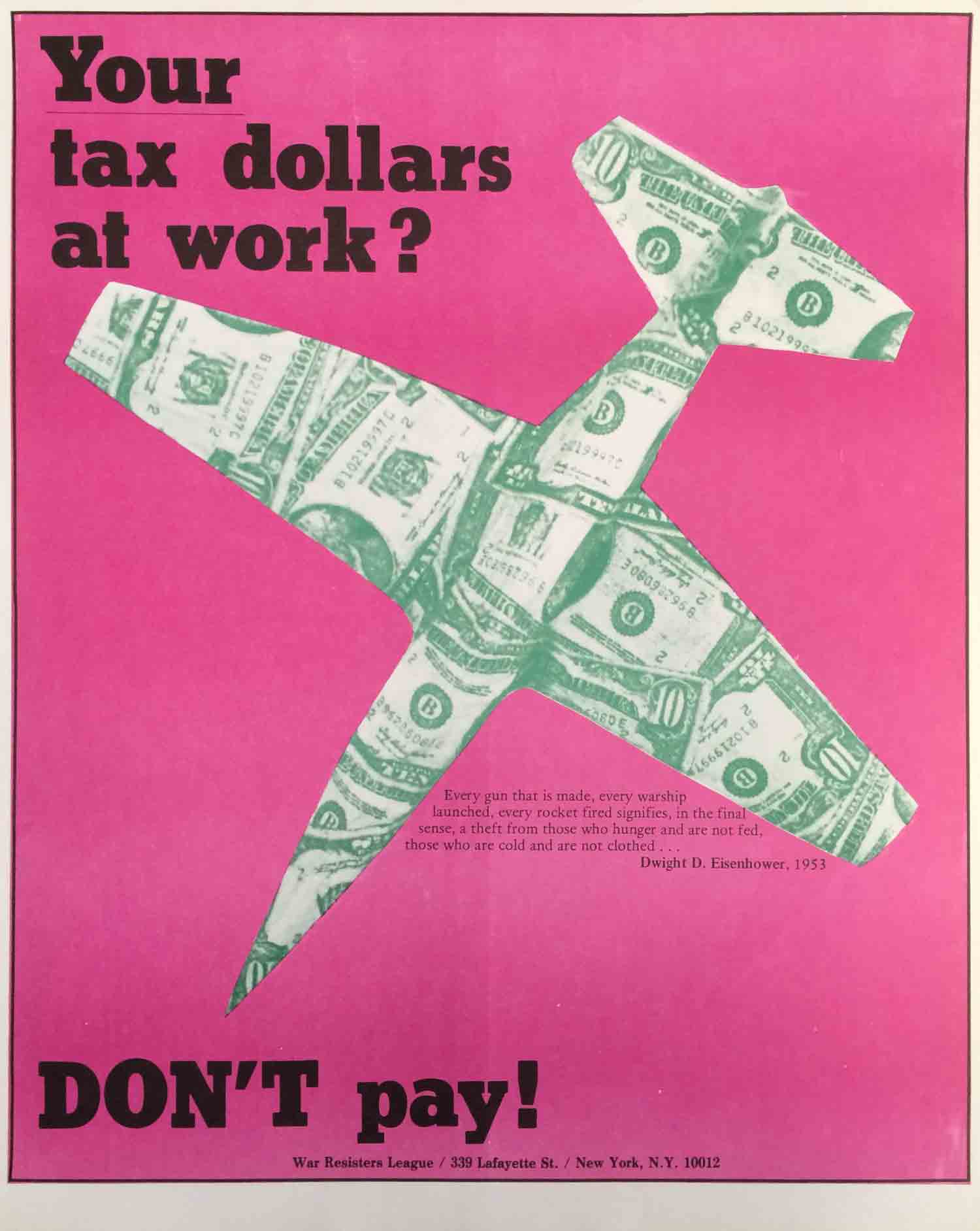

Divest from war!! Refuse to pay all or part of your federal income tax. Though illegal, thousands of people openly participate in this form of protest. Whatever you choose to refuse—$1, $10, 45% or 100%—send a letter to elected officials and tell them why. Contact us for information or referral to a counselor near you. Contribute resisted tax money to groups that work for the common good.

For more about refusing to pay for war, brochures, and other resources, contact the National War Tax Resistance Coordinating Committee, (800) 269-7464 or see nwtrcc.org.

Order a DVD of NWTRCC’s film, Death and Taxes from WRL’s online store.

JUST PUBLISHED! Read and use War Tax Resistance: A Guide to Withholding Your Support from the Military – 6th Edition – handbook with history, methods and resources

| Weight | 0.2 oz |

|---|---|

| Dimensions | 11 × 8.5 × 0.005 in |

Product Catalog

Product Categories

90th Anniversary 95th Anniversary 100th Anniversary Anti-nuclear Civil Disobedience Conscientious Objectors Counter Recruitment Resources Gifts GI Rights Nonviolence Raffle Tickets This Year's Calendars War Profiteers War Tax Resistance Women