Where Your Income Tax Money Really Goes FY2022 (Published in 2021)

$0.15

Last Chance to Buy Last Year’s Pie Chart!

Perfect for Tax Day leafletting, as a focus for forums and panels and workshops and more!

8752 in stock

| Quantity | Discount | Discounted price |

| 201 – 499 | $12.00 | $0.00 |

| 500 + | $0.10 | $0.05 |

The new War Resisters League’s famous “pie chart” flyer, Where Your Income Tax Money Really Goes, analyzes the Federal Fiscal Year 2022 Budget (FY 2022 is 1 October 2021 – 30 September 2022. This FY2022 issue was published in March 2021.

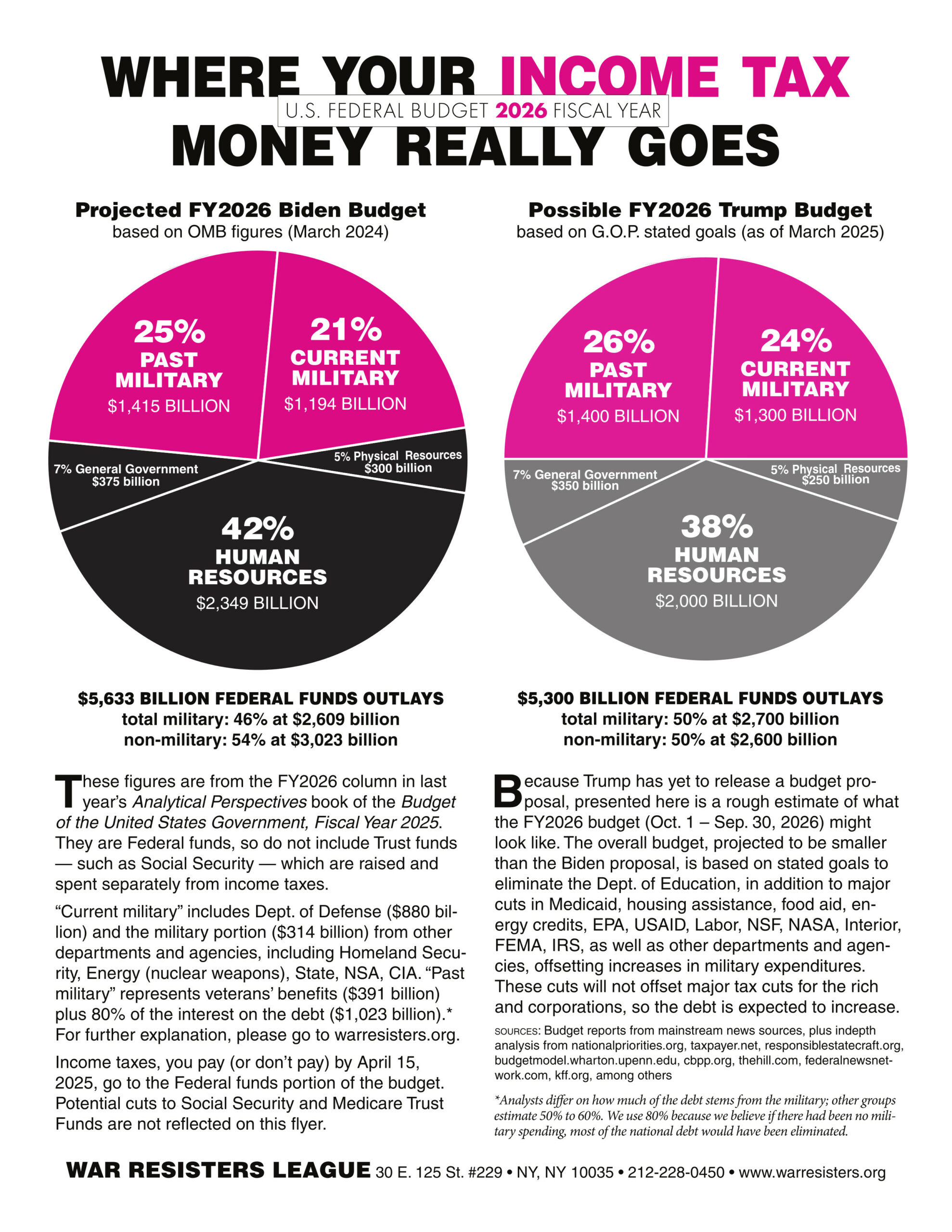

Each year War Resisters League analyzes federal funds outlays as presented in detailed tables in “Analytical Perspectives” of the Budget of the United States Government. Our analysis is based on federal funds, which do not include trust funds – such as Social Security – that are raised separately from income taxes for specific purposes. What federal income taxes you pay (or don’t pay) by April 15, 2020, goes to the federal funds portion of the budget.

HOW THESE FIGURES WERE DETERMINED

These figures are from the FY2022 column in the Analytical Perspectives book of the Budget of the United States Government, Fiscal Year 2021, issued last year, as the new budget with Covid relief has yet to be released this year. The figures are Federal funds, which do not include Trust funds — such as Social Security — that are raised and spent separately from income taxes.

What you pay (or don’t pay) by May 17, 2021, goes to the Federal funds portion of the budget. The government practice of combining Trust and Federal funds began during the Vietnam War, thus making the human needs portion of the budget seem larger and the military portion smaller.

Analysts differ on how much of the debt stems from the military; other groups estimate 50% to 60%. We use 80% because we believe if there had been no military spending, most of the national debt would have been eliminated.

WHAT YOU CAN DO

Leaflet with this flyer year-round and on Tax Day, May 17, 2021, and during the Global Days of Action on Military Spending, April 13-May 9, demilitarize.org, and year round.

Get involved in WRL’s organizing and education work: nonviolent direct action training, counter-military recruitment, internationalist work, and more. Visit WRL’s membership handbook at warresisters.org/joinwrl. Find resources to challenge militarism, curb police and border patrol power, strengthen nonviolent action and lift up community resilience!

Write elected officials letters-to-the-editor, and posts online. Send and share copies of this flyer. Explain your budget priorities for a better world.

Divest from war! Refuse to pay all or part of your federal income tax. Though illegal, thousands of people openly participate in this form of protest. Whatever you choose to refuse—$1, $10, 48% or 100%—send a letter to elected officials and tell them why. Contact us for information or referral to a counselor near you. Contribute resisted tax money to groups that work for the common good.

For more about refusing to pay for war, brochures, and other resources, contact the National War Tax Resistance Coordinating Committee, (800) 269-7464 or see nwtrcc.org.

Order a DVD of NWTRCC’s film, Death and Taxes from WRL’s online store.

Read and use War Tax Resistance: A Guide to Withholding Your Support from the Military, a 144-page handbook with history, methods and resources. Available for $5 plus postage from WRL’s online store.

You can also download the flyers and print them locally:

Fiscal Year 2022 (Released March 2021) Pie Chart Flyer

in English, in color (pdf)

in English, black & white (pdf)

in Spanish, in color (pdf)

in Spanish, black & white (pdf)

We offer these downloads free of charge, but we really appreciate your donation to support the work of producing this important resource each year. If you can, donate today!

For Pie Charts from previous years, check out the Pie Chart Archives

Discounts applied at check out (or by clicking on View Cart):

1-200 $.15

201-499 $.12

500+ $.10

| Weight | 0.2 oz |

|---|---|

| Dimensions | 11 × 8.5 × 0.005 in |

Product Catalog

Product Categories

90th Anniversary 95th Anniversary 100th Anniversary Anti-nuclear Civil Disobedience Conscientious Objectors Counter Recruitment Resources Gifts GI Rights Nonviolence Raffle Tickets This Year's Calendars War Profiteers War Tax Resistance Women

WRL Perpetual Calendar

WRL Perpetual Calendar