*** THIS IS THE PIE CHART THAT WAS PUBLISHED IN MARCH 2022 ***

OUR NEW PIE CHART THAT ANALYZES THE FEDERAL FISCAL YEAY 2023 BUDGET IS IN PRODUCTION AND WILL BE AVAILABLE ANY DAY NOW

Perfect for Tax Day leafletting, as a focus for forums and panels and workshops and more!

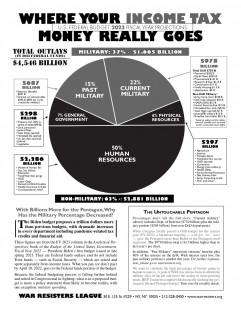

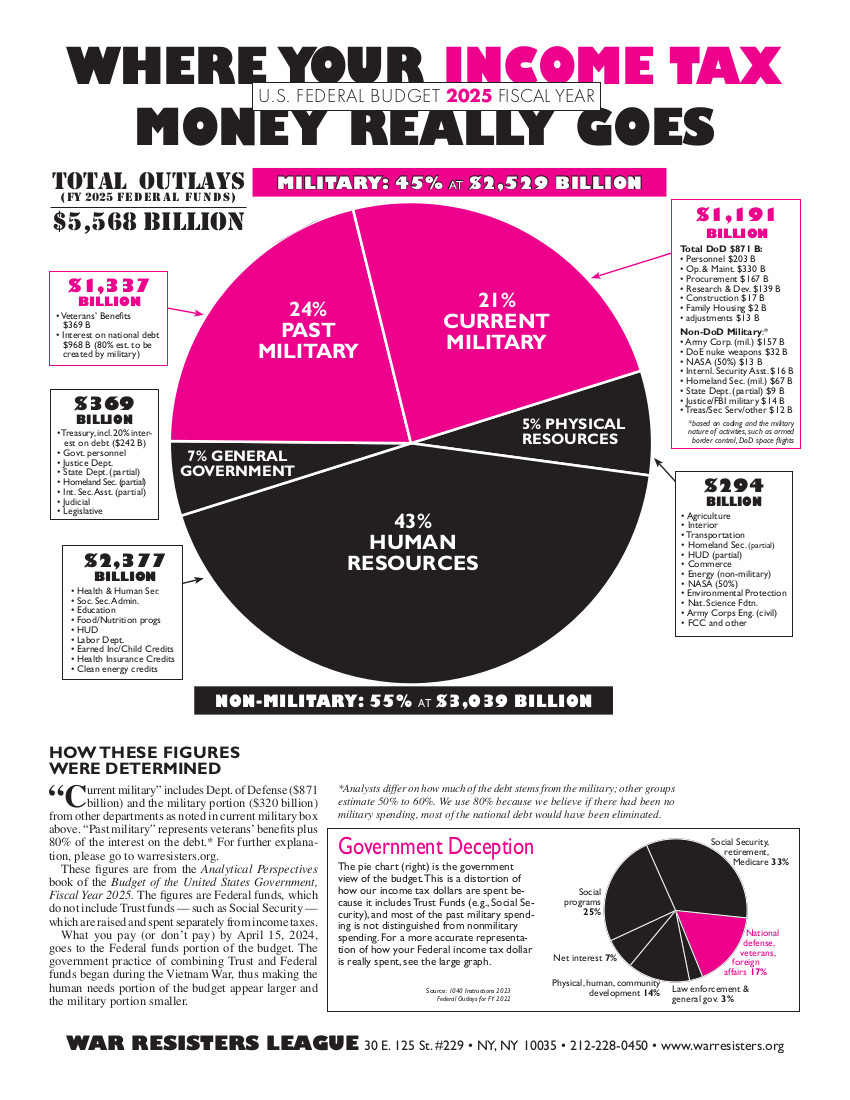

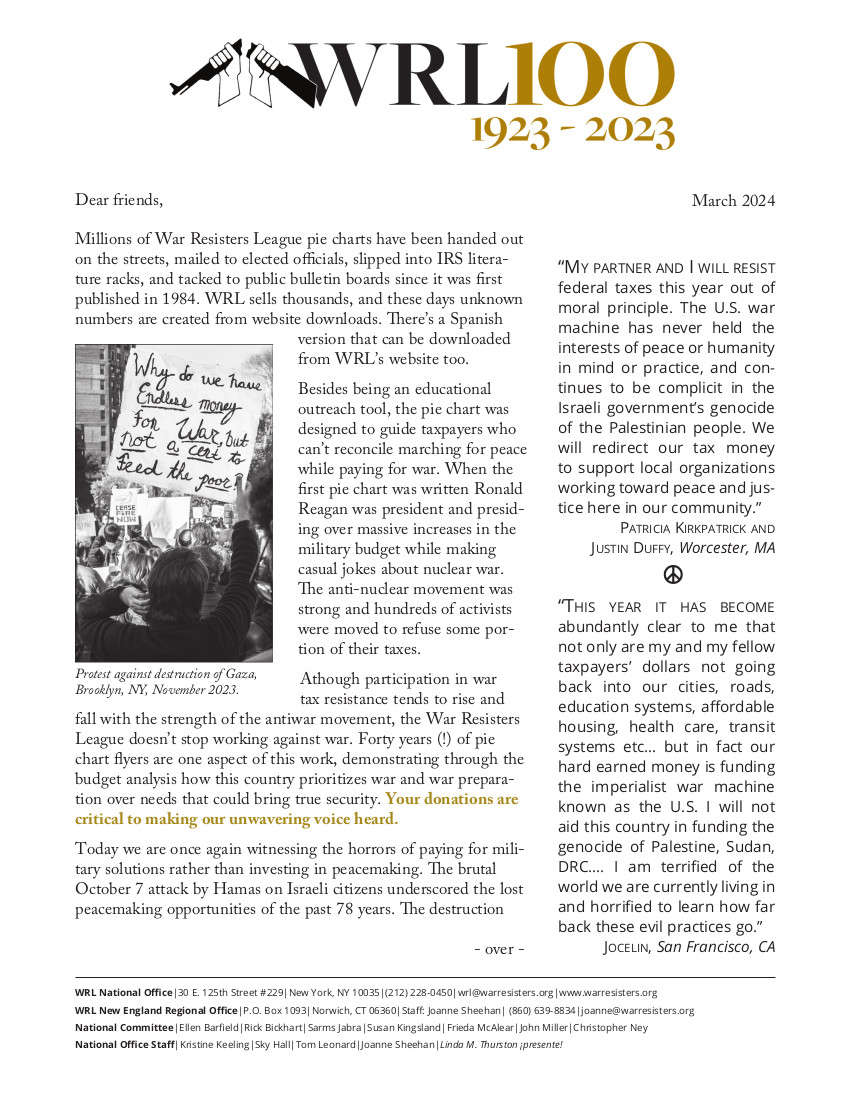

The new War Resisters League's famous "pie chart" flyer, Where Your Income Tax Money Really Goes, analyzes the Federal Fiscal Year 2023 Budget (FY 2023 is 1 October 2022 - 30 September 2023. This FY2023 issue was published in March 2022.

Each year War Resisters League analyzes federal funds outlays as presented in detailed tables in "Analytical Perspectives" of the Budget of the United States Government. Our analysis is based on federal funds, which do not include trust funds - such as Social Security - that are raised separately from income taxes for specific purposes. What federal income taxes you pay (or don't pay) by April 15, 2020, goes to the federal funds portion of the budget.

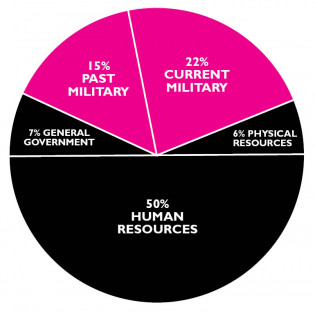

WITH BILLIONS MORE FOR THE PENTAGON, WHY HAS THE MILITARY PERCENTAGE DECREASED?

The Biden budget proposes a trillion dollars more than previous budgets, with dramatic increases in every department including pandemic-related tax credits and financial aid

These figures are from the FY 2023 column in the Analytical Perspectives book of the Budget of the United States Government, Fiscal Year 2022 — President Biden’s first budget issued in late spring 2021. They are Federal funds outlays and do not include Trust funds — such as Social Security — which are raised and spent separately from income taxes. What you pay (or don’t pay) by April 18, 2022, goes to the Federal funds portion of the budget. Because the federal budgeting process is falling further behind and mired in Congressional in-fighting, what is in a proposed budget is more a policy statement than likely to become reality, with one exception: military spending.

THE UNTOUCHABLE PENTAGON

Percentages don’t tell the full story. “Current military” (see chart) includes Dept. of Defense ($730 billion) plus the military portion ($248 billion) from non-DoD departments.

When Congress finally passed a DoD budget for the current year (FY 2022), a bipartisan majority — with few “no” votes — gave the Pentagon more than Biden or the Pentagon itself requested. The $978 billion total is $13 billion higher than in last year’s pie chart.

In addition, “Past Military” represents veterans’ benefits plus 80% of the interest on the debt. With interest rates low, the past military portion is smaller this year.

We want to celebrate the high percentage of money going to human resources. A goal of WRL has always been to shrink the military slice of the pie and move the money to more pressing needs. BUT it must be coupled with drastically slashing the grotesquely bloated Pentagon budget. Turn over for a reality check.

WHAT YOU CAN DO

Leaflet with this flyer year-round and on Tax Day, April 18, 2022, and throughout the The War Industry Resisters Network, Tax Day Week of Action, April 17-24; also see demilitarize.org.

Get involved in WRL’s organizing and education work: nonviolent direct action training, counter-military recruitment, internationalist work, and more. Visit WRL’s membership handbook at warresisters.org/joinwrl. Find resources to challenge militarism, curb police and border patrol power, strengthen nonviolent action and lift up community resilience!

Write elected officials, letters-to-the-editor, and posts online. Send and share copies of this flyer. Explain your budget priorities for a better world.

Divest from war! Refuse to pay all or part of your federal income tax. Though illegal, thousands of people openly participate in this form of protest. Whatever you choose to refuse—$1, $10, 48% or 100%—send a letter to elected officials and tell them why. Contact us for information or referral to a counselor near you. Contribute resisted tax money to groups that work for the common good.

For more about refusing to pay for war, brochures, and other resources, contact the National War Tax Resistance Coordinating Committee, (800) 269-7464 or see nwtrcc.org. Support the Peace Tax Fund legislation: peacetaxfund.org.

Order a DVD of NWTRCC's film, Death and Taxes from WRL's online store.

Read and use War Tax Resistance: A Guide to Withholding Your Support from the Military, a 144-page handbook with history, methods and resources. Available for $5 plus postage from WRL's online store.

You can also download the flyers and print them locally:

Fiscal Year 2023 (Released March 2022) Pie Chart Flyer

in English, in color (pdf)

in English, black & white (pdf)

We offer these downloads free of charge, but we really appreciate your donation to support the work of producing this important resource each year. If you can, donate today!

For Pie Charts from previous years, check out the Pie Chart Archives

Discounts applied at check out (or by clicking on View Cart):

1-200 $.15

201-499 $.12

500+ $.10

**Special Collectors Print Edition!** There is a typo in the headline of the printed version of these pie charts (it reads 'Where Your Income Tax Really Money Goes'). You can use this mix-up as an ice-breaker while distributing the flier (suggested script: “You really need to see this”), or download PDF of the corrected one above.

***NOTE ABOUT SHIPPING*** Pie chart orders are being mailed no later than 48 hours after receiving the order. Orders of 50 and more are sent priority mail, which arrives in 2-3 days. Postage costs more than 20%, an additional donation is appreciated.